The Bank of England has chosen to introduce a system to fintech financial institutions that can make exchanges over blockchain possible for users without much of a stretch procedure. The Bank is presenting its interior bank payment system in this realm of cryptocurrency.

The Blockchain Payment System

On Monday, the National Bank of Britain published a report assessing its ongoing Proof-of-Concept (PoC) with some firms working in the distributed ledger technology (DLT) space. This test was planned to look at the possibility of interfacing blockchain firms to a refreshed variant of the bank’s Real-Time Gross Settlement (RTGS) benefit.

It is interesting because right now, the RTGS encourages payments between money related organizations, taking care of roughly 500 billion pounds worth of exchanges or one-fourth of the nation’s evaluated total national output (GDP).

The Governor of the Bank of England, Mark Carney, stated that; “No longer will access to central bank money be the exclusive preserve of banks.” The governor said all these last month noting a key feature of the bank’s “ambitious rebuild” of RTGS intended to introduce it for the private payment system and also for the DLT firm.

Many startups participated in PoC which was conducted in March, highlighted investment from DLT new businesses Baton Systems, Clearmatics Technologies, R3, and Token. As indicated by the recently distributed give an account of the preliminary, all members communicated certainty that they could associate with the RTGS to settle exchanges designated in national bank cash.

The English government expects the UK to remain the central place for money related execution like payments and exchanges. Bank of England made it clear in its announcement that:

“All participants confirmed that the functionality offered by the renewed RTGS service would enable their systems to connect and to achieve settlement in central bank money,” “whether the renewed RTGS service could provide and consume acceptable forms of cryptographic proofs.”

The Bank of England made contact with Ripple, the San Francisco-based blockchain startup to preliminary an interledger framework intended to synchronize instalments between national banks, however, Bank of England authorities resolved at the time that blockchain innovation was “not adequately develop” for DLT firms to be upheld on the.

This is astonishing news since fintech firms could likewise begin utilizing RTGS. Be that as it may, it’s not simply uplifting news for the organizations, it is uplifting news for banks in the UK in view of their looming withdrawal from the European Union. Furthermore, at this moment they are doing their best to draw in fintech firms to the nation. The bank would also like to have the new RTGS framework online by 2020.

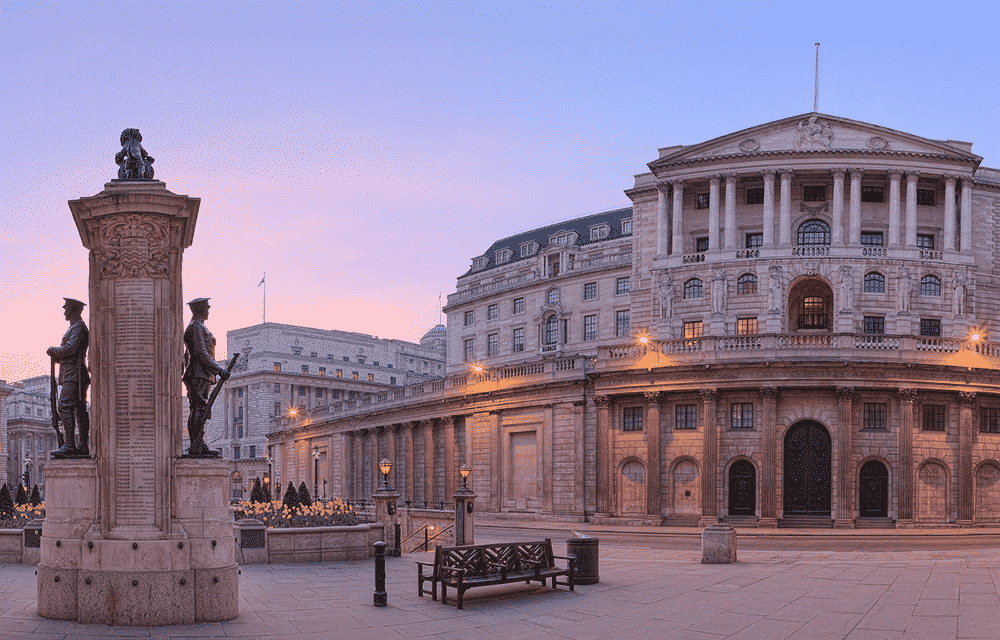

Image Courtesy of Simple Communicate