Ripple’s CEO, Brad Garlinghouse, said that Bitcoin will not be able to keep controlling the prices of cryptocurrencies. The prices of virtual currencies tend to follow Bitcoin’s trend. It is difficult to see Bitcoin falling or skyrocketing and other currency behaving independently from it.

Bitcoin Controls the Market

For Mr. Garlinghouse, cryptocurrencies have different features and operate in different way one from the other. But as soon as the market will realize about these differences, alt-coins will stop following Bitcoin’s trend.

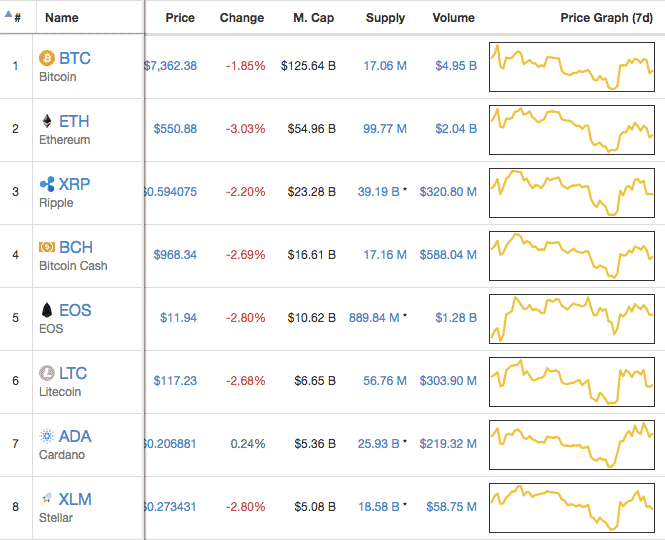

The image shows how most of the virtual currencies in the market behave in a similar way.

“There’s a very high correlation between the price of XRP and the price of bitcoin, but ultimately these are independent open-sourced technologies,” commented Garlinghouse. It’s early, over time you’ll see a more rational market and behaviours that reflect that.”

Ripple (XRP) is one of the most important virtual currencies in the market. At the moment of writing this article, XRP is the third cryptocurrency by market capitalization with $23 billion dollars. Each coin can be purchased by $0.59 dollars. Additionally, most of the virtual currencies are operating negatively.

Mr. Garlinghouse said about the virtual currency market:

“It’s still a nascent industry, the speculation in the market dominates the trading activity. I think it’s a matter of time until people better understand the different use cases. There’s gonna be a bit of correction along the way here where a lot of the players in the space that don’t actually sole a real problem are going to get washed out.”

There are more than 1,600 cryptocurrencies in the market, and some of them have been proved as scams. It is very important for individuals to be very careful when investing and deciding where to place their bets.

Different regulatory offices are working hard so as to regulate the market, virtual currencies, and the activities around them.

Ripple Expands

Ripple has many different products and services that Ripple Labs offers to the market. Several banking institutions and other financial agencies are working with them. For cross-border payments, it is very important to reduce transaction costs and time, and this is what Ripple is able to do.

Some of the products offered by Ripple are being used by MoneyGram, Santander Bank, and more than a dozen different central banks from all over the world.

Real customers with real use cases: #xRapid pilots prove financial institutions can settle in minutes with up to 70% in savings. Results do speak louder than words. https://t.co/ggsTXsRFYX

— Brad Garlinghouse (@bgarlinghouse) May 10, 2018

According to the first pilots results for xRapid, one of the latest Ripple products, financial institutions using xRapid saw savings of 40-70% percent compared to what they normally pay foreign exchange brokers.

A blog post uploaded by Asheesh Birla, SVP product at Ripple, reads as follows:

“This is the realization of the vision for an Internet of Value – allowing for a new fluid movement of money that will benefit the entire global economy, from families that rely on remittance payments, to corporations loosing to expand and scale into markets in new countries.”